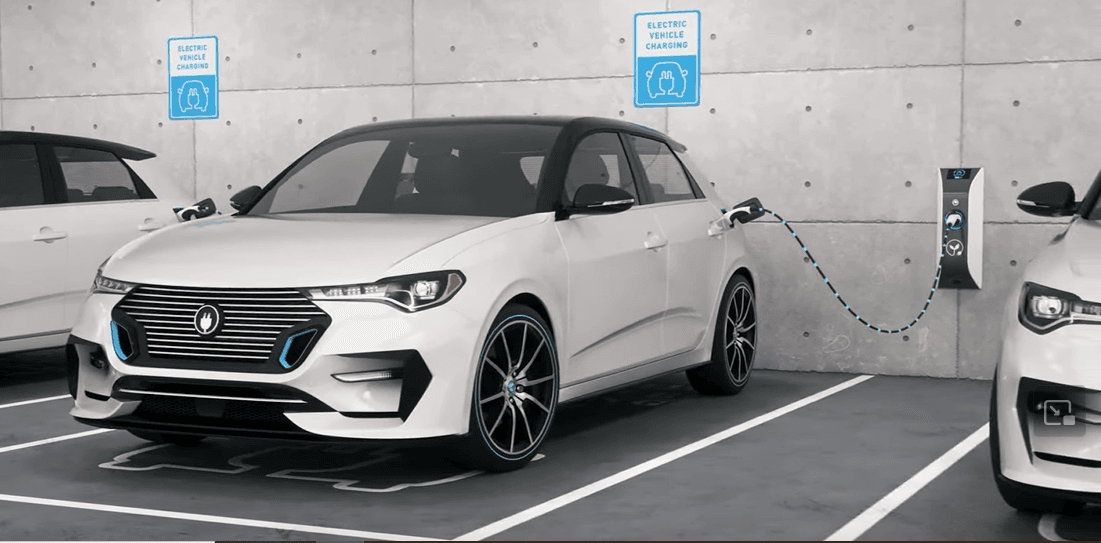

Introduction: Accelerating Toward an Electric Vehicles Future

India’s Electric Vehicles (EV) revolution is shifting gears. With climate commitments, urban pollution concerns, and a booming automotive market, the government and industry are aligning to make 2025 a landmark year. Central to this push are two transformative initiatives: the New Battery Swapping Policy and the anticipated FAME-III (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme. Together, they aim to address cost barriers, infrastructure gaps, and consumer confidence, propelling India closer to its goal of achieving 30% EV penetration by 2030.

Table of Contents

The 2025 EV Roadmap: Targets and Vision

India’s EV roadmap for 2025 is ambitious yet pragmatic. Key targets include:

- 5 million annual EV sales by 2025 (up from ~1.5 million in 2023).

- 100,000 public charging stations (including 15,000 battery-swapping hubs).

- Localizing 80% of lithium-ion battery production to reduce import dependence.

The government’s focus extends beyond cars to two-wheelers (45% of current EV sales) and commercial vehicles like e-rickshaws and buses, which dominate last-mile connectivity. The roadmap also emphasizes renewable energy integration, with solar-powered charging stations and green hydrogen pilots for long-haul trucks.

Battery Swapping Policy: Revolutionizing “Refueling”

What is Battery Swapping?

Instead of charging a fixed battery, users replace depleted batteries with pre-charged ones at automated kiosks, slashing downtime from hours to minutes. This “swap and go” model is particularly impactful for fleet operators and low-income users.

Key Features of the Policy:

- Standardized Batteries: Mandating uniform battery specifications (size, voltage) across brands to ensure interoperability.

- Subsidized Infrastructure: Financial support for startups and energy giants like Reliance and Tata to set up swapping stations.

- Incentivized Adoption: Reduced GST (from 18% to 5%) for swappable batteries and tax rebates for commercial EV buyers.

Pioneers Leading the Charge:

- Sun Mobility: Partnering with Tata Motors and Ashok Leyland to deploy 500+ stations across Delhi-NCR and Bengaluru.

- Bounce Infinity: Targeting gig workers with subscription plans for e-scooter batteries at ₹399/week.

- Ola Electric: Integrating swapping stations into its Hypercharger network, prioritizing autorickshaws.

Challenges Ahead:

- Standardization: OEMs like Bajaj and Hero resist uniform batteries, fearing loss of competitive edge.

- Safety: Ensuring fire-resistant designs and real-time monitoring of swapped batteries.

FAME-III: Fueling Affordability and Innovation

While FAME-II (2019–2024) boosted early adoption, FAME-III (expected in late 2024) is designed to scale mass-market EV adoption.

Anticipated Features:

- Increased Subsidies: Up to ₹50,000 for e-two-wheelers (vs. ₹22,500 under FAME-II) and ₹2.5 lakh for e-cars.

- Focus on Swappable Batteries: Additional incentives for EVs compatible with swapping infrastructure.

- Rural Outreach: Subsidies for village-level charging hubs powered by solar energy.

Impact on Key Segments:

- E-Rickshaws: Drivers in UP and Bihar could save ₹300/day with subsidized batteries.

- Luxury EVs: Mercedes and BMW may localize production to qualify for FAME-III benefits.

Industry Reactions:

- Nirmala Sitharaman, Finance Minister: “FAME-III will prioritize indigenization, aligning with Atmanirbhar Bharat.”

- P Balaji, CFO, Tata Motors: “The scheme could reduce EV prices by 15–20%, narrowing the ICE-EV cost gap.”

Synergy Between Swapping and FAME-III

The battery swapping policy and FAME-III are mutually reinforcing:

- Cost Reduction: Swapping lowers upfront costs (no battery purchase), while FAME-III subsidies make EVs like the Tata Nexon EV (₹14 lakh post-subsidy) accessible.

- Fleet Electrification: Logistics giants like Blusmart and Zomato are adopting swappable e-scooters, leveraging FAME-III incentives to replace 50,000 ICE vehicles by 2025.

- Grid Stability: Swapping stations with solar storage can feed excess power back to the grid, supported by FAME-III’s renewable energy mandates.

Challenges on the Road to 2025

- Infrastructure Gaps: Only 2,000 swapping stations exist today vs. a 15,000 target.

- Consumer Trust: Post-fire incidents, 68% of buyers still prioritize safety over cost (CEEW-CEF 2024 Survey).

- Supply Chain Risks: Dependence on Chinese lithium and cobalt imports persists despite PLI schemes.

The Road Ahead: What’s Next?

By 2025, India’s EV ecosystem could see:

- Battery-as-a-Service (BaaS): Startups like Chargeup and RACEnergy offering pay-per-swap models.

- Green Hydrogen Integration: Toyota and Ashok Leyland testing hydrogen-fueled swaps for trucks.

- Global Leadership: Tata’s ₹15,000 crore gigafactory poised to export batteries to ASEAN and Africa.

Conclusion: A Charged Future

India’s 2025 EV roadmap is more than a policy—it’s a socio-economic reset. By aligning battery swapping’s agility with FAME-III’s financial muscle, the nation is poised to democratize EVs for its 1.4 billion people. While challenges remain, the collective momentum of policymakers, OEMs, and startups signals a transformative decade ahead. As R.C. Bhargava, Maruti Suzuki Chairman, notes, “The 2025 targets are ambitious, but India’s frugal innovation can turn them into reality.”